Is Your Credit Score Ready to Buy in Maine? Here’s What You Need to Know

Buying a home in Maine is an exciting journey, but is your credit score ready for it? Your credit score plays a major role in determining whether you qualify for a mortgage and how favorable your loan terms will be. Let’s break down everything you need to know about credit scores before buying a home in Maine.

Understanding Credit Scores

What is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. It’s based on your credit history, including how well you manage debt, make payments, and handle credit accounts. Most lenders use the FICO score, which ranges from 300 to 850.

Why Does Your Credit Score Matter for Home Buying?

Lenders use your credit score to assess risk. A higher score means lower risk, making you eligible for better mortgage rates and loan options. A lower score, on the other hand, may result in higher interest rates or even loan denial.

Minimum Credit Score Requirements for Buying a Home in Maine

Different loan types have different credit score requirements. Here’s what you need to know:

Conventional Loans

-

Typically require a minimum credit score of 620.

-

Higher scores (740+) get the best interest rates and lower down payments.

FHA Loans

-

Backed by the Federal Housing Administration.

-

Minimum credit score of 580 with a 3.5% down payment.

-

If your score is 500-579, you may still qualify but will need a 10% down payment.

VA Loans

-

Available for veterans and active-duty military members.

-

No official minimum credit score, but most lenders prefer 620 or higher.

USDA Loans

-

Designed for rural and suburban homebuyers.

-

Minimum credit score of 640 is recommended for easier approval.

How to Check Your Credit Score

Free Credit Score Services

You can check your credit score for free through:

-

AnnualCreditReport.com (offers a free report from each major credit bureau once a year)

-

Credit Karma

-

Your bank or credit card provider

Understanding Your Credit Report

Your credit report details your credit history, including missed payments, outstanding debts, and credit inquiries. Review it carefully and dispute any errors that could be lowering your score.

Ways to Improve Your Credit Score Before Buying a Home

Pay Bills on Time

Payment history is the biggest factor affecting your credit score. Set up automatic payments or reminders to never miss a due date.

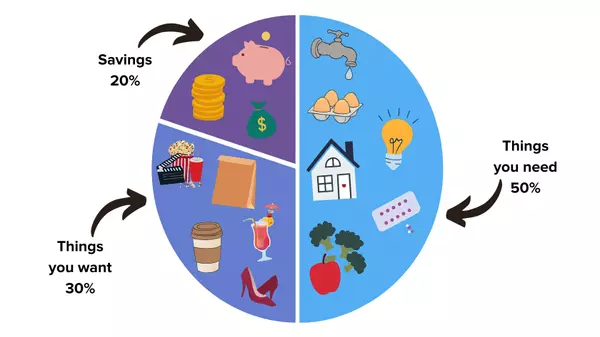

Reduce Credit Utilization

Try to use less than 30% of your available credit. Paying down credit card balances can quickly boost your score.

Avoid Opening New Credit Accounts

New credit inquiries temporarily lower your score. Avoid applying for new credit cards or loans before applying for a mortgage.

Dispute Errors on Your Credit Report

Mistakes happen. If you find incorrect information on your credit report, dispute it with the credit bureau to have it corrected.

Alternative Home Buying Options if Your Credit Score is Low

Rent-to-Own Programs

Rent-to-own agreements allow you to rent a home with the option to buy it later. This can be a good option if you need time to improve your credit score.

Working with a Co-Signer

If your credit score is too low to qualify on your own, a co-signer with good credit can help you secure a mortgage.

Exploring Down Payment Assistance Programs

Maine offers various first-time homebuyer programs that can help with down payments, reducing the financial burden.

Conclusion

Your credit score plays a critical role in buying a home in Maine. Understanding where you stand and taking steps to improve your score can make a huge difference in securing the best mortgage rates and loan options. If your score isn’t where it needs to be yet, don’t worry! Take proactive steps now, and you’ll be on the path to homeownership sooner than you think.

FAQs

1. Can I buy a home in Maine with a 580 credit score?

Yes! FHA loans allow buyers with a credit score of 580 to qualify with a 3.5% down payment. Other options may be available, depending on the lender.

2. How long does it take to improve a credit score?

Improving your credit score can take a few months to a year, depending on the issues you need to fix. Paying bills on time and reducing debt are the fastest ways to see improvement.

3. What credit score is needed for the best mortgage rates?

A credit score of 740 or higher will typically get you the best interest rates on a mortgage.

4. Are there first-time homebuyer programs in Maine?

Yes! Programs like MaineHousing provide down payment assistance and competitive interest rates for first-time buyers.

5. Can I buy a home with no credit history?

It’s challenging but possible. Some lenders accept alternative credit histories, such as rent and utility payment records, but a co-signer or higher down payment may be required.

Ready to take the next step in your real estate journey? Whether you’re buying, selling, or just exploring your options, I’m here to help! Let’s make your goals a reality. Contact me today at 207.387.5416 or craig@craigpriestlyrealestate.com to get started!

Categories

Recent Posts