How to Save for a Home in Maine Without Sacrificing Life’s Big Moments

Buying a home is one of life’s biggest milestones—but saving for it can feel impossible when rent, weddings, vacations, and day-to-day expenses pile up.

If you’re renting in Maine, you might already feel the pinch. As of 2025, the average rent for a one-bedroom in Portland is around $1,900 and closer to $1,500 in towns like Brunswick or Freeport. Add in rising grocery and gas costs, and it’s no wonder saving feels harder than ever.

Now mix in wedding season: between travel, outfits, gifts, and bachelor/bachelorette weekends, the average cost of attending a wedding in New England is about $2,000. That’s basically another month’s rent! Attend a couple of weddings in a summer, sprinkle in birthdays, holiday trips, and spur-of-the-moment adventures, and your down payment fund takes a serious hit.

But here’s the truth: you don’t have to skip life’s celebrations to become a homeowner in Maine. You just need a strategy.

Why Saving Feels So Hard Right Now

We’re in a season of high rents, rising home prices, and inflation that makes everything from lobster rolls to heating oil more expensive. Without a clear system, it’s easy to:

👉 Dip into savings for “just one” event

👉 Let subscriptions and little expenses pile up

👉 Delay saving because the target feels too big

In fact, a recent survey found:

-

45% of renters said they’ve made a housing sacrifice to afford wedding celebrations.

-

25% skipped an event altogether because it was just too expensive.

-

Many are choosing smaller rentals or roommates just to save more each month.

But a few smart shifts can make saving realistic again.

7 Money Habits for Maine Renters to Start Today

Here are simple strategies I recommend to renters and future homeowners across Southern Maine:

1. Set Your Budget

Before saying “yes” to any trip or invitation, know what you can actually afford.

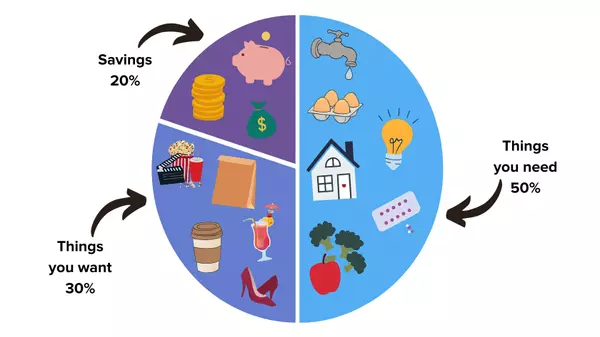

Try the 50/30/20 rule:

-

50% = needs (like rent & bills)

-

30% = wants (celebrations, trips, lobster dinners)

-

20% = savings or debt repayment

2. Treat Housing Savings Like a Bill

Your down payment isn’t optional. Automate transfers into a separate high-yield savings account every payday—out of sight, out of mind.

3. Build a “Whoops Fund”

Unexpected car repairs or last-minute wedding invites happen. Use round-up apps like Acorns or stash extra cash in a Maine-based credit union savings account for better interest.

4. Negotiate Your Rent or Bills

In July 2024, 36% of rentals in the U.S. offered concessions like free parking or discounted rent. In Maine’s competitive rental market, it’s always worth asking your landlord or exploring incentives when your lease renews.

Also, call your utility, phone, or internet provider to see if you can trim costs.

5. Be Intentional with Events

You don’t need to attend every pre-wedding party. Prioritize the events that matter most and look for ways to cut costs—share rides, rent outfits, or split Airbnbs with friends.

6. Automate Everything

Autopay your bills and automate your savings so discipline doesn’t rely on willpower.

7. Know Your Loan Options

Here’s the biggest myth: you don’t always need 20% down. In Maine, there are first-time homebuyer programs through MaineHousing that can lower your down payment to as little as 3% or even 0% with VA or USDA loans.

The Big Picture

Saving for a home in Maine feels challenging—but it’s 100% possible. With intentional money moves, you can enjoy weddings on Peaks Island, weekend trips to Acadia, and still hit your homeownership goals.

Owning a home in Southern Maine—whether it’s in Freeport, Brunswick, or Yarmouth—doesn’t happen by accident. But with the right plan, you can celebrate life’s milestones today and still secure your dream home tomorrow.

Categories

Recent Posts